Happy Labor Day: Why Fall Is a Smart Time to Buy a Home

As summer winds down and we head into fall, the housing market finds a new rhythm. The high-energy pace of June–August gives way to a steadier September–October—often with more balanced conditions. Buyers typically face less competition than in spring, while sellers still meet motivated movers who want to be settled before the holidays. In short: timing, strategy, and preparation matter most right now.

The Big Question: “Should I wait for rates to go down?”

Short answer: Waiting can be risky. This week’s data shows why.

📊 Market Snapshot (as of August 28)

-

Mortgage Rates: 30-year fixed averaged 6.56%, the lowest since early October 2024.

-

Fed Outlook: At Jackson Hole, Fed Chair Jerome Powell signaled restrictive policy may be adjusted soon—markets rallied, and odds of a September rate cut jumped.

-

Mortgage Spread: The gap between the 10-year Treasury and 30-year mortgage rates tightened to a three-year low, helping pull rates down.

Why it matters: Even if the Fed trims rates in September, technical ceilings in mortgage bond pricing could limit how much lower mortgage rates can go. Meanwhile, home prices in our market continue appreciating. Holding out for tiny rate improvements can mean paying more for the same home a few months from now.

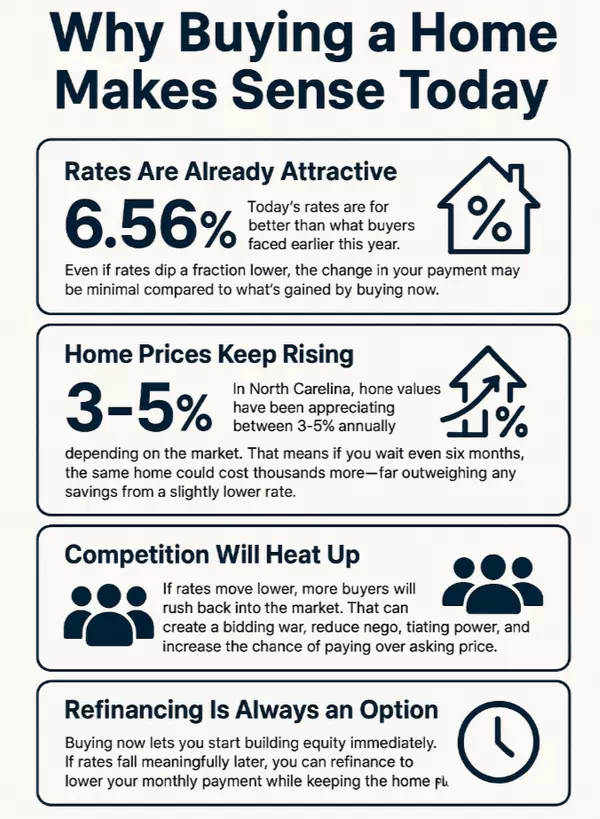

Why Acting Now Makes Sense

✅ Rates Are Already Attractive

At 6.56%, today’s rates are better than many buyers faced earlier this year. A tiny dip later may have minimal impact on your monthly payment compared to what you gain by owning sooner.

📈 Home Prices Keep Rising

Across North Carolina, home values have been appreciating 3–5% annually (market dependent). Wait six months and the same home could cost thousands more—often wiping out any benefit from a slightly lower rate.

👥 Competition Will Heat Up

If rates slip further, more buyers rush back, sparking bidding wars, reducing negotiating power, and raising the chance of paying over asking.

🔁 Refinancing Is Always an Option

Buy now, build equity immediately. If rates meaningfully decline later, you can refinance to lower the payment while keeping the home you want.

⏱️ Timing the Market Rarely Works

Real estate rewards buy-and-hold, not waiting for the “perfect” moment. The cost of waiting is almost always higher than the benefit of perfect timing.

🎥 A Quick Conversation on “Why Not to Wait”

I sat down with a mortgage-broker friend to run the numbers and explain why waiting for lower rates can backfire.

👉 Watch the video on YouTube: A Conversation with Sean Cutchens

What to Watch Next

Key labor-market reports (including Jobs Report and ADP private payrolls) arrive next week. With recent volatility, these will heavily influence the September 17 Fed meeting—and the next move for mortgage rates.

Let’s Make Your Next Best Move

Mortgages can feel overwhelming—I’m here to simplify the big picture. Acting while rates are stable and before competition jumps can set you up for long-term success in homeownership.

Ready for a tailored plan?

I’ll walk you through the numbers, explore options, and—with one of my trusted mortgage partners—help you decide if now is the right time to buy or refinance.

👉 Click here to schedule a time to connect

—

Janet Austin

Realtor® | True North Realty

Categories

Recent Posts

Buyer Services

We're here to help you find the home of your dreams. With a team of experts guiding you every step of the way, our extensive knowledge and experience will ensure you have the best home buying experience possible.

Seller Services

We take the stress out of selling your home by providing a seamless experience from start to finish. Our team will put you in the best position to market your home and sell it for the highest possible price.