August 25 Market Minute: What First-Time Buyers Need to Know

Buying your first home is one of life’s biggest milestones. It’s exciting, but it can also feel overwhelming—especially in today’s shifting market. This week, I’m dedicating the Market Minute to first-time buyers, giving you a clear snapshot of what’s happening in the economy and the five most important things you should know as you prepare to buy.

Market Update

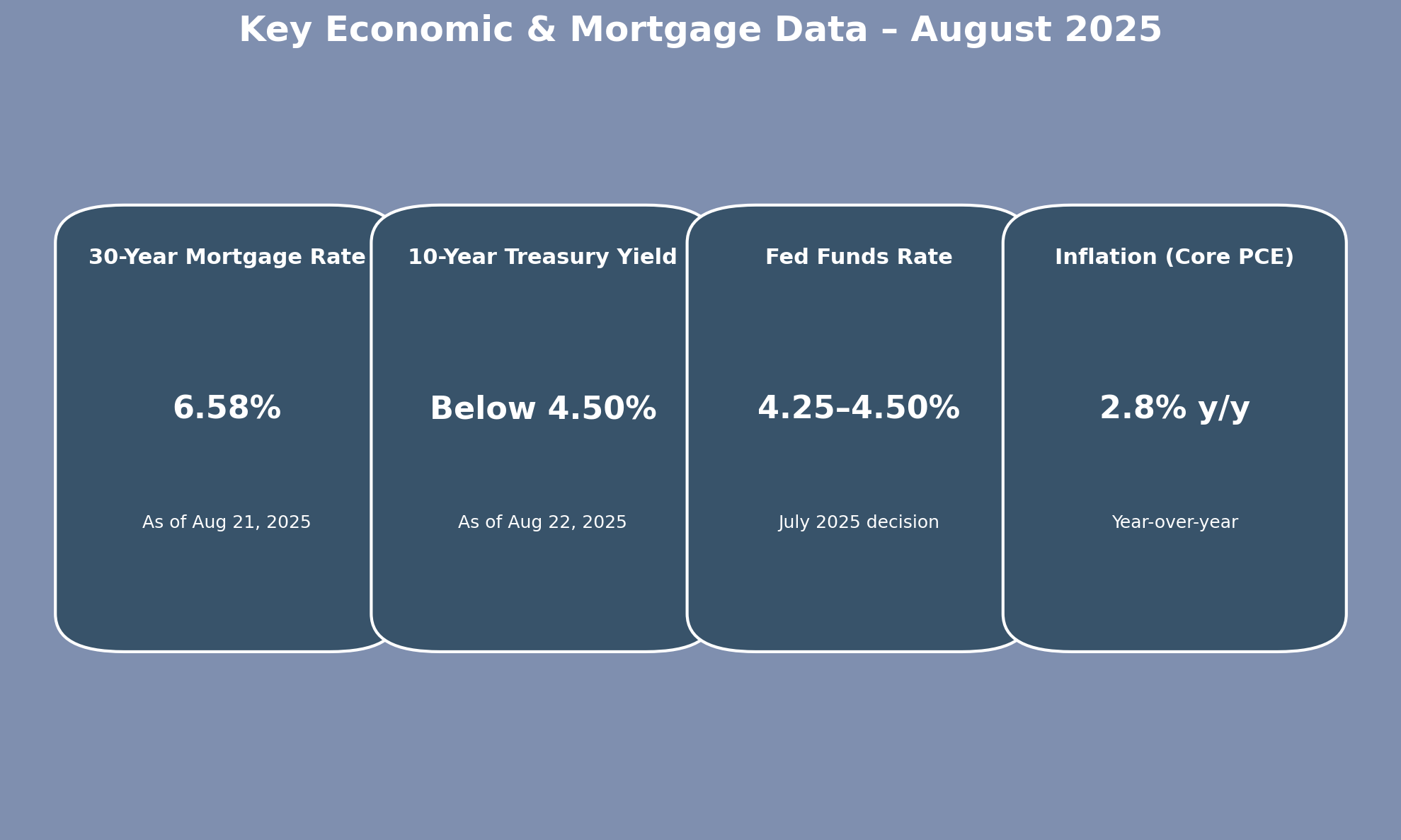

Mortgage rates have held steady for two weeks now at 6.58% for a 30-year fixed loan (as of August 21, 2025), marking the lowest levels in nearly a year. This stability is welcome news for buyers, especially after the highs of 2023 and early 2024.

Lower rates don’t just reduce monthly payments—they also increase purchasing power, which means buyers may be able to consider homes that were out of reach just months ago.

At the same time, inflation continues to cool, with the Core PCE index at 2.8% year-over-year, still above the Fed’s 2% target but showing progress. The Federal Reserve kept its benchmark rate at 4.25–4.50% during its July meeting, though two members dissented in favor of a cut—the first signal in decades of internal debate leaning toward easing.

For today’s buyers, that means a window of opportunity: steady rates, improving affordability, and the chance for further relief if inflation keeps trending in the right direction.

📊 Key Data – August 2025

Top 5 Things First-Time Buyers Should Know

-

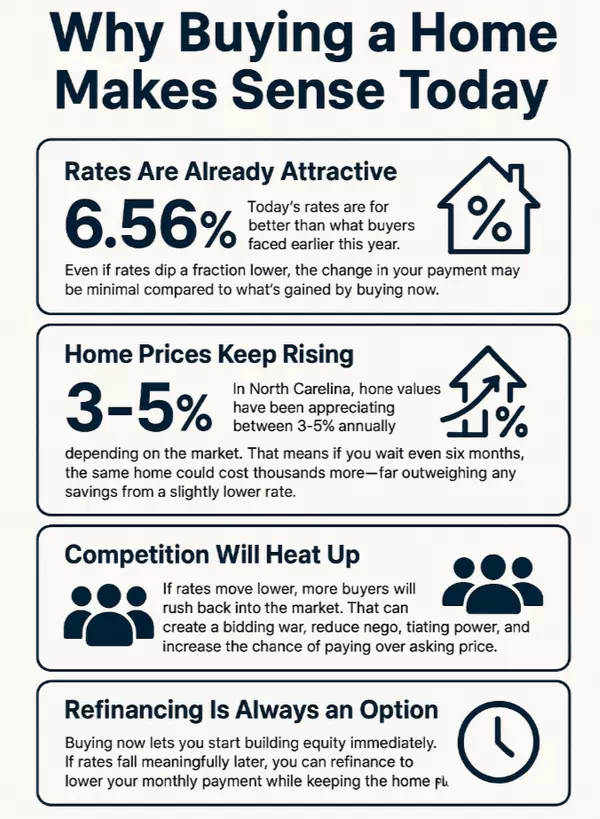

Take Advantage of Lower Rates

Mortgage rates are near their lowest point of the year. While waiting for a further dip can be tempting, home values generally rise over time—so locking in now while building equity may be smarter than holding out. -

Budget Beyond the Mortgage

Your monthly mortgage payment is only one piece of the puzzle. Be prepared for closing costs, homeowners insurance, property taxes, and routine maintenance. -

Get Pre-Approved Early

In competitive markets like Hickory, Charlotte, and Asheville, being pre-approved signals to sellers that you’re serious and gives you an edge when making offers. -

Fall is a Smart Buying Season

As summer winds down, inventory often increases while competition cools. This gives first-time buyers more options and more negotiating power compared to the spring rush. -

Lean on Trusted Guidance

Buying your first home is a big step, but you don’t have to go it alone. Working with an experienced real estate agent and the right mortgage professional ensures you’re supported from start to finish.

Final Thoughts

Helping first-time buyers is one of the most rewarding parts of my work. Seeing clients step into their first home—while knowing they’ve made a sound decision for their future—is why I love what I do.

If you’re thinking about buying your first home, I’d love to help you compare neighborhoods, explore options, and create a clear plan to make it happen.

👉 Click here to schedule a time to connect.

Warm regards,

Janet Austin

True North Realty

truenorthrealtync.com

Categories

Recent Posts

Buyer Services

We're here to help you find the home of your dreams. With a team of experts guiding you every step of the way, our extensive knowledge and experience will ensure you have the best home buying experience possible.

Seller Services

We take the stress out of selling your home by providing a seamless experience from start to finish. Our team will put you in the best position to market your home and sell it for the highest possible price.